The Current State of Electronic Health Record (EHR) Data Access

Where and when did it all start?

The historic enactment of the CMS Meaningful Use program as part of the Health Information Technology for Economic and Clinical Health (HITECH) Act - along with the $36 billion worth of “incentives for the use of Health Information Technology” - rapidly increased the adoption of Electronic Health Records (EHRs) for medical institutions across the country.

EHR Growth from 2010-2018: 96% of US health providers have implemented EHRs and 74% of patients can enable patient portal access to their own medical records.

This rapid expansion of electronic health data provided new opportunities for other institutions to leverage this new digital data repository to provide meaningful use to consumers. The traditional approach for obtaining this medical information was by Fax or Mail (which is still heavily in use today). This approach is slow, clostly and does not allow for any level of automation or scale - much less optimization of a digital business process (such as adjudicating a disability claim). In other words, it does not provide for any level of true innovation.

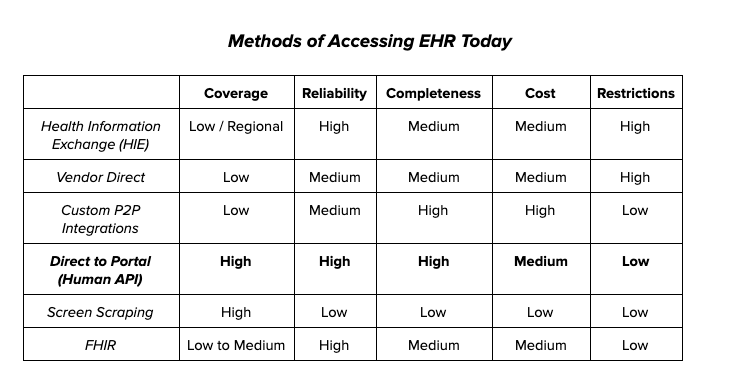

But without a clear electronic interoperability standard of accessing this ever-growing electronic data asset, several different options have emerged over the past decade.

The Methods of Accessing Electronic Health Data

Here are the six methods to digitally access electronic health data today, along with examples of companies that use each approach:

#1 - Health Information Exchanges (HIEs)

Over the past decade, several Health Information Exchanges have been established - at an independent, governmental, or regional level. These organizations are in many cases enabled and supported financially by statewide health information exchange grants from the Office of the National Coordinator for Health Information Technology (ONC).

HIEs by nature are very regional and therefore their practical hit rates are low. For example, a vendor called Clareto (they used to operate as MedVirginia) is a federated HIE offering that only has touch points to several states to date. While this certainly has applicability for providers in those states looking to share health data, it doesn’t support the needs of companies that operate on a national level (for example, many of our insurance customers are Fortune 500 financial services companies that need access to a national health data network).

Other HIE networks can be larger in scope, such as Commonwell Health. This is a larger alliance of smaller networks. However, their initial mandate was to service provider-to-provider authorizations or “Treatment” use cases, and they don’t serve consumer-driven use cases with the same level of coverage leading to similar coverage issues. Additionally, HIEs often don’t have the ability to dictate what data elements are shared (i.e. doctor’s notes are very rarely available, and even some common data elements like medications may be missing from some providers).

Some HIEs organize data into a central repository and then generate their own outputs. While the standardized output may be easier to consume, it also means that health data is often reduced to the “lowest common denominator” of data element availability and specificity. This data incompleteness can severely limit the HIE’s possible use cases.

Treatment Use Cases Only

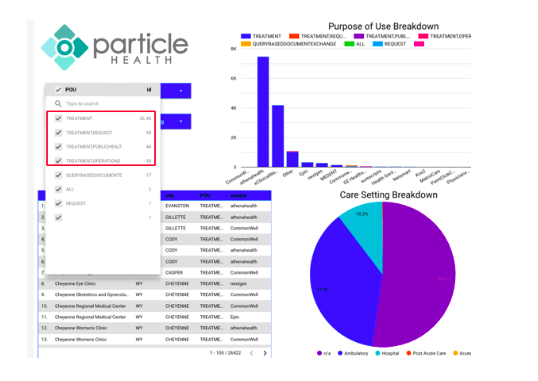

Examples of companies that leverage this technology: Particle Health, Clareto

#2 - Vendor Direct Access

Much like HIEs, some EHR vendors provide network services so that third parties can connect directly to their systems. And much like HIEs, a significant drawback of these vendor networks is market penetration. While there are dominant players, the space is still fairly fragmented.

EHR Market Share 2018

Within each vendor there are also multiple versions and solutions that exist (i.e., there is no ‘one size fits all’ capability per vendor for all their EHRs). One such solution is Epic’s Chart Gateway. Epic designed Chart Gateway specifically for the Financial Service Sector (e.g., insurance underwriting). The biggest drawback for this approach is that very few Epic hospitals actually connect to the gateway itself to enable this service. To date, less than 20 health systems were on the roadmap to offer this integration. Epic’s Care Anywhere solution has significantly more penetration within their client base, but it is also limited to a provider-to-provider use case.

Examples of companies that leverage this technology: MIB, Cognizant

#3 - Custom Point-to-Point Integrations

Several IT vendors exist today who will create specific tunnels/pipelines between individual systems to fulfill a very specific use case. These integrations can be robust as they are purpose-built, but they are costly, take time to develop, and are limited to only servicing distinct interactions. One good use of this integration technique is within an individual health system to a specific outside entity, like a telemedicine provider for a hospital.

Examples of companies that leverage this technology: Redox, Mulesoft

#4 - Direct-to-Portal Integration

“Direct to Portal” integrations are specific connections to each individual electronic health record (EHR) provider portal for each health system. These integrations are consumer-facing and thus require users to provide their login credentials. The shared data can be used for any enterprise use case as it’s the consumer themselves who are the legal disclosing entity of their data.

This integration provides a robust data set in the form of a CCD (Continuity of Care Document). This CCD includes a material amount of healthcare data, both structured and unstructured, which is designed to provide a clinical history of the consumer, including but not limited to Vitals, Social History, Metabolic Panels, Urinalysis, Medications, and Physician Notes.

This integration strategy provides a fast, reliable, connection but requires integrations to each individual provider portal. Much like the issues with Vendor Direct Access, while there are some dominant players in the space, it is still fragmented and each vendor supports multiple versions and multiple implementations of each of their EHRs. This means that you would have to manually integrate with each specialized EHR portal.

This is the primary integration strategy we’ve used to build our platform (although we’re constantly on the lookout to add alternative data sources that can deliver more value to our customers). So far, we’ve created over 28,000 individual integrations directly to EHRs via a proprietary technique resulting in the first (and largest) national consumer-controlled health data platform. We also invested a lot of time and resources building a machine learning pipeline that ingests, normalizes, and structures the unstructured data coming from the disparate systems, so data is usable and actionable for our customers. We believe this approach expands on the application and use case of consumer health data while taking away the complexity and inefficiencies of having to aggregate and clean up health data from fragmented health IT systems.

We’ve found that patient portals tend to have more consistent data elements than HIEs, as HIE data quality is highly variable from provider to provider, due to each of them being set up differently (with different requirements for their member providers, resulting in non-standardized outputs). Because patient portals have less data variability, they’re generally more reliable. Here is a sample de-identified CCD that is typically retrieved through our platform using the direct-to-portal method.

#5 - Screen Scraping

Screen scraping is the process of collecting screen display data from one application and translating it so that another application can display it. It is similar to the Direct to Portal approach in that it requires integration with each individual provider portal, but It is dependent on exactly what data is displayed on the screen and where.

This technology has two significant limitations:

1) Data can only be pulled that is presented on the screen (i.e., data is incomplete)

2) As screens change layouts, these integrations must be concurrently updated (i.e. the interfaces can break and are therefore unreliable)

#6 - FHIR (Fast Healthcare Interoperability Resources)

One API strategy getting a lot of traction and attention in the market today is FHIR (Fast Healthcare Interoperability Resources). The FHIR API is a new data standard layout that provides for the exchange of health information. Like all healthcare IT standards before it, it is limited by the speed of adoption (which is still low) and the manner in which it is implemented. Organizations will take their own unique approaches to interpreting and adopting the “standard”, which will ultimately create significant variability in how data is populated within each template (much like the HL7 versions that came before it).

FHIR boasts speed and reliability but still requires patient credential to access their information and to date provides less data than the direct to portal approach, e.g., FHIR does not provide for Encounter data or Doctor’s notes within APIs.

FHIR Adoption relative to older HL7 versions

Examples of companies that leverage this technology: Apple

Apple is creating a lightweight personal health record (PHR) on iOS devices. While this is not an enterprise solution, Apple is leveraging FHIR-based integrations and to date has about a 12% penetration in the market. Note that this approach requires the consumer to provide their portal login credentials.

Where we are today and where the industry is going

The opportunities to leverage electronic health records (EHR) data today are far superior to those that existed just 10 years ago. But even with the abundance of EHR data available, it’s the access to that data that is lagging behind and stifling innovation within our larger healthcare ecosystem.

The initial focus of various health data integration approaches, such as HIEs, was to provide for more robust treatment & care within a healthcare setting (i.e. provider-to-provider), but these methods are limited for driving applications in adjacent markets. We believe that adjacent markets are what will ultimately drive consumer utility of access to their healthcare data, and power innovation.

The new health data sharing rules - opening up health data access to consumers

The US Department of Health & Human Services (HHS) recently finalized two historic rules to give patients more control of their own health data. Under HIPAA, providers may share health data with other providers. But under the new rules, providers must share that information with patients, providers, and other parties unless they meet one of eight exclusions outlined by HHS. These rules will give patients more control and access to their health data, and empower more consumers to be able to share data with the companies they trust.

Dr. Don Rucker, the national coordinator for health information technology, said in a statement:

"Delivering interoperability actually gives patients the ability to manage their healthcare the same way they manage their finances, travel, and every other component of their lives. This requires using modern computing standards and APIs that give patients access to their health information and give them the ability to use the tools they want to shop for and coordinate their own care on their smartphones. A core part of the rule is patients' control of their electronic health information which will drive a growing patient-facing healthcare IT economy, and allow apps to provide patient-specific price and product transparency."

There is widespread public and private support for this new initiative, which includes big technology companies like Google, Amazon, Microsoft, and Apple. The CEO of Cerner - one of the largest EHR vendors - showed his support for the new health data sharing rules on their company blog. As we’ve seen in other industries, consumers demand personalization and want to educate themselves on the services and products in the market in order to make decisions for themselves. We believe this is going to be no exception when it comes to their health. The new data sharing rules will push for more open healthcare APIs and make more data available to consumers through patient portals and other user interfaces. This will strengthen our consumer-controlled health data platform, allowing us to evolve alongside the industry.

With the passing of these new regulations, we expect consumers to become more comfortable with being the stewards of their own health data and transacting with their data in exchange for value. This is behavior we’re already seeing in other industries such as finance, travel, hospitality, etc. We put consumers in the middle of our platform because they are at the center of the rapidly evolving health ecosystem. Our mission of putting consumers in full control of their own health data is fully aligned with the spirit of the new health data sharing rules, and we believe the trend of open data access and consumer empowerment will only continue to strengthen our direct-to-portal approach over time.